Update

EEBA is now Goodbudget! Goodbudget has all the great features of EEBA (and more!) in a new and updated interface. Check out our updated article on this topic, and check out the Goodbudget Help Center for the most recent help content.

Q: I’ve decided to finally pay off my credit cards! How can I use EEBA to keep track of how much I owe, how much I want to pay, and how close I am to achieving my goal?

Paying off debt is a great financial goal. You may feel the pinch in the short term, but in the long run you’ll save money and enjoy greater peace of mind. With EEBA, you’ll have two options when keeping track of your debt.

Option 1: Track the Balance of Your Debt (Plus/Premium)

If you’re on the Plus or Premium plan with EEBA, you can use Accounts to keep track of the balance of your debt as you pay it off. Here’s how:

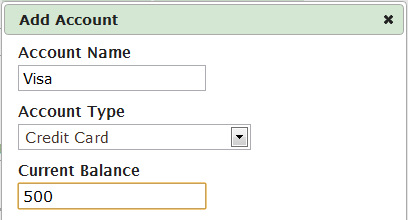

Step 1.Create a Credit Card Account for Each Debt

Head to the Accounts page to create a new Credit Card Account for each debt you want to track. Enter the balance of the Account as a positive number, equal to the current balance that you owe.

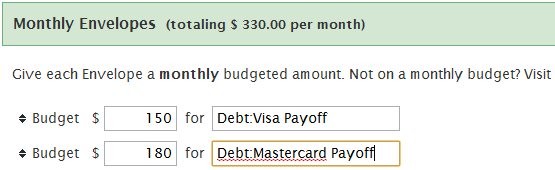

Step 2. Create a Debt Payoff Envelope to Budget for Your Payments

Go to the Edit Budgets page and create a Regular Envelope with a budget of how much you’d like to pay each month toward your Debt. If you’re keeping track of more than one debt, use Envelope Groups to keep them organized.

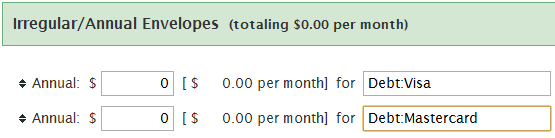

Step 3. Create a Debt Balance Envelope to Track each Debt

Then, scroll down to the Irregular / Annual Envelopes section and create an Envelope with a budget of “0” for each debt. If you used Envelope Groups in Step 2, use the same grouping here.

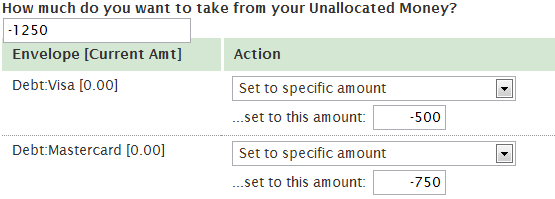

Step 4. Distribute the Debt to the Debt Envelopes

Then use the Distribute from Unallocated page to properly set the balance of the Debt Balance Envelopes. If you owe 500 on an Account, set the Debt Balance Envelope to -500. Note that you’ll need to distribute negative amounts of money.

Step 5. Record a Payment

When you make a payment on your debt, record that as:

- An Account Transfer to the Credit Card Account, and

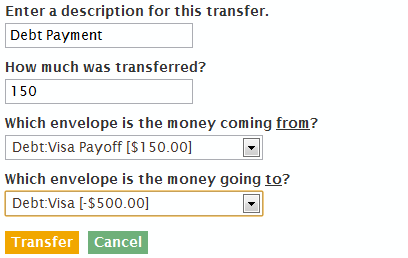

- An Envelope Transfer from the Debt Payoff Envelope to the Debt Balance Envelope.

If you incurred interest during this payment period, or if part of the payment was to interest and not to the principal of the debt, record the interest amount as a new expense to the Debt Balance Envelope and the Debt Account.

Option 2: Budget Your Debt Payments as a Regular Expense

Regardless of what plan you’re on, you can always budget for your debt payments as a regular expense.

Step 1. Create an Envelope for Each Debt

Go to the Edit Budgets page and create an Envelope for each debt. Set the budget of the Envelope to how much you expect to pay each month. You can use Envelope Groups to help keep things organized.

For example:

- Debt:Credit Card 1

- Debt:Credit Card 2

Step 2. Distribute Funds to the Envelope

Fund your Debt Envelope as part of your normal budget.

Step 3. Make a Payment

When you make a payment, record that as an expense to the Debt Envelope.

(If you’re using Accounts, record the expense as paid from the Account you’re paying from. ie. Your Checking Account.)