Paying off debt is a great way to become financially stable and to make space in your budget for other money goals. The key to paying off debt is finding a system that helps motivate and encourage you along the way.

The Debt Snowball method is one we recognize for its ability to build momentum, which helps motivate folks to stick to the plan. It helps you pay off debt quickly by challenging you to use all of your extra money towards paying on your smallest debt first. After that’s paid off, your snowball is a bit bigger, and you can then put that towards paying off your second smallest debt. And you continue on until you’re debt free.

Here’s how you can get started with Debt Snowball in Goodbudget using your existing Debt Accounts.

If you’re not using Debt Accounts yet, be sure to create a Debt Account for each debt that you want to pay off. Then proceed to Step 1 below.

Step 1: Find your Snowball

Your snowball is the amount of money you have available for debt payments. It includes the difference between your planned expenses and your total income per month.

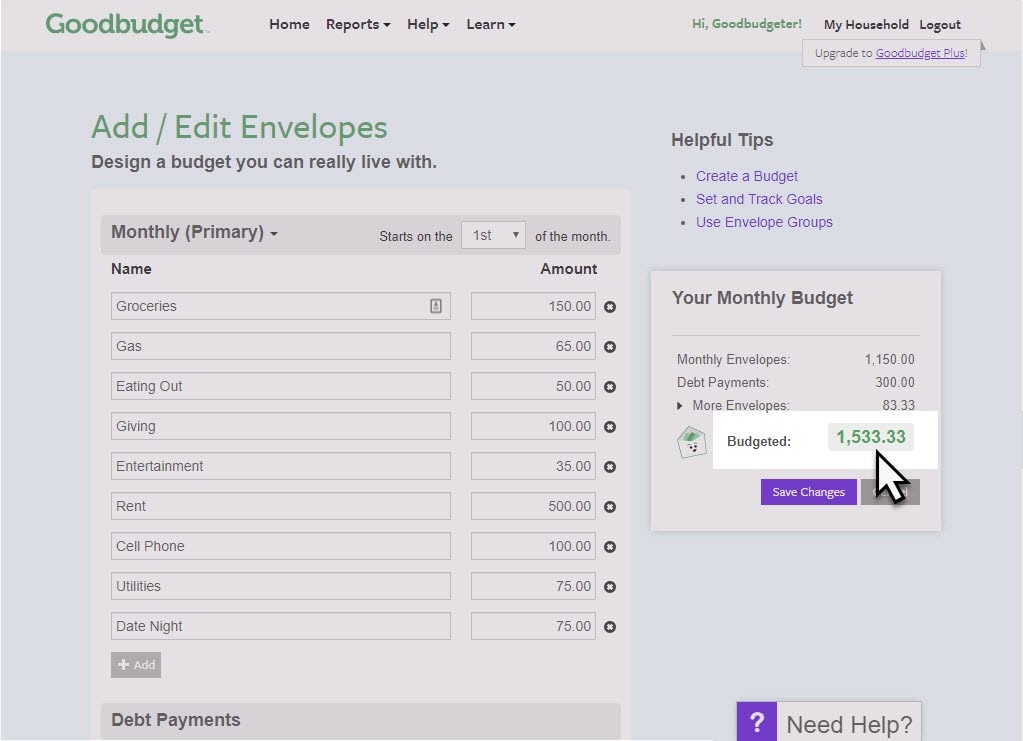

To get started, figure out how much you bring in each month. Do that on the Goodbudget website, click on Reports and then select the Income vs. Spending report. Write down your total income for last month. Based on the screenshot below, we have 1700 to work with.

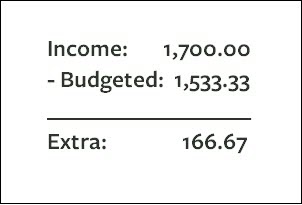

Next, click on Add/Edit on the Envelopes tab to quickly find your ‘Budgeted’ number (it’s the green number on the right side of the screen). Subtract that number from your income and write the difference down — it’s part of your snowball and you’ll add it to the amount you already pay on your smallest debt later on.

Note: If your budget matches up exactly with your paychecks, and you want to put more money towards paying down debt, you’ll have a bit of extra work. First, find Envelopes where you can pull back, so that you have some cash available for these debt payments. Do you consistently underspend on Groceries or Fun? Then that’s where you can find some extra cash — adjust those budgeted amounts and refer to your new ‘Budgeted’ figure on the right side of the screen.

Step 2: Add your Snowball to your Debt Account

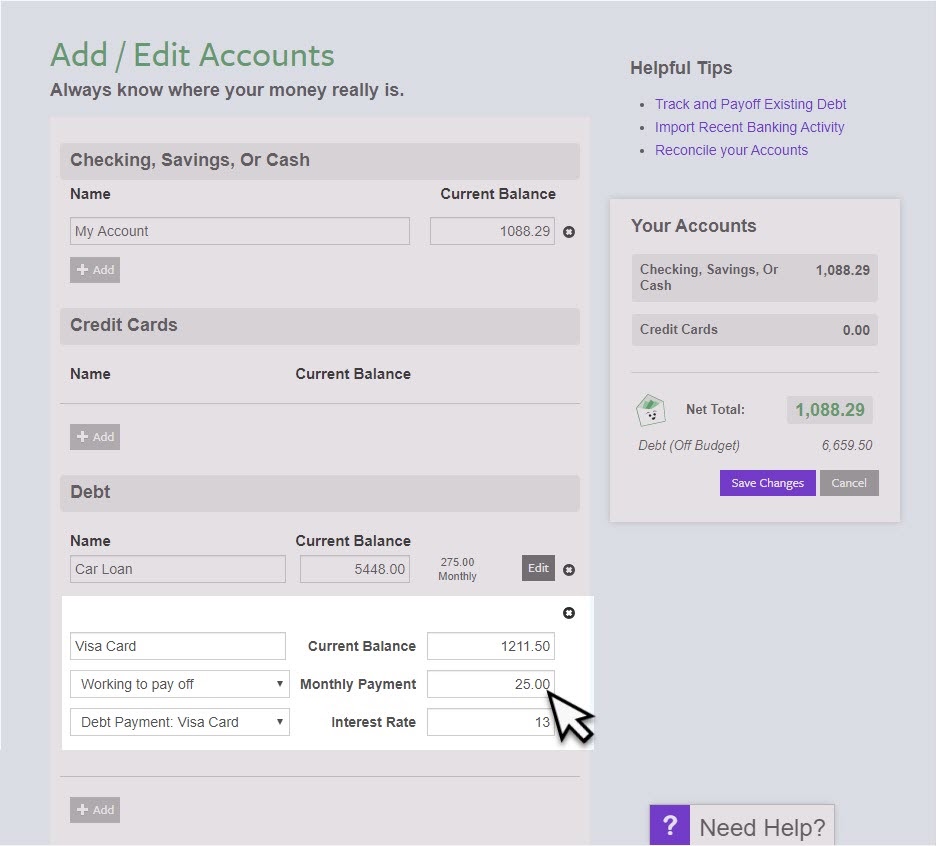

You’ll do that by adding that figure you gathered in the previous step on top of your smallest Debt Account’s Monthly Payment. Head to the Add/Edit Accounts page and find your Debt with the smallest Monthly Payment. Next, click edit to make those changes, and be sure to save them when you’re done.

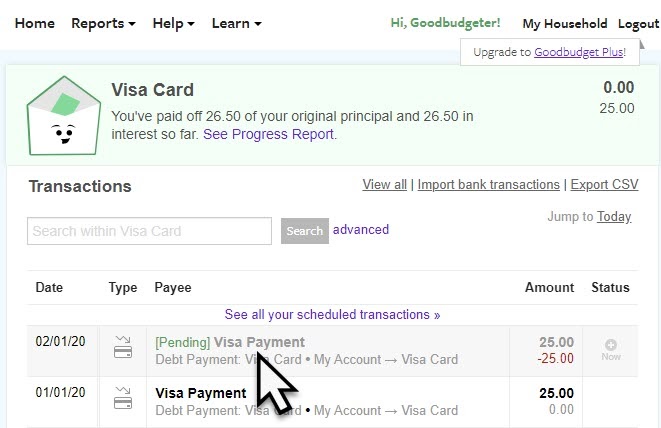

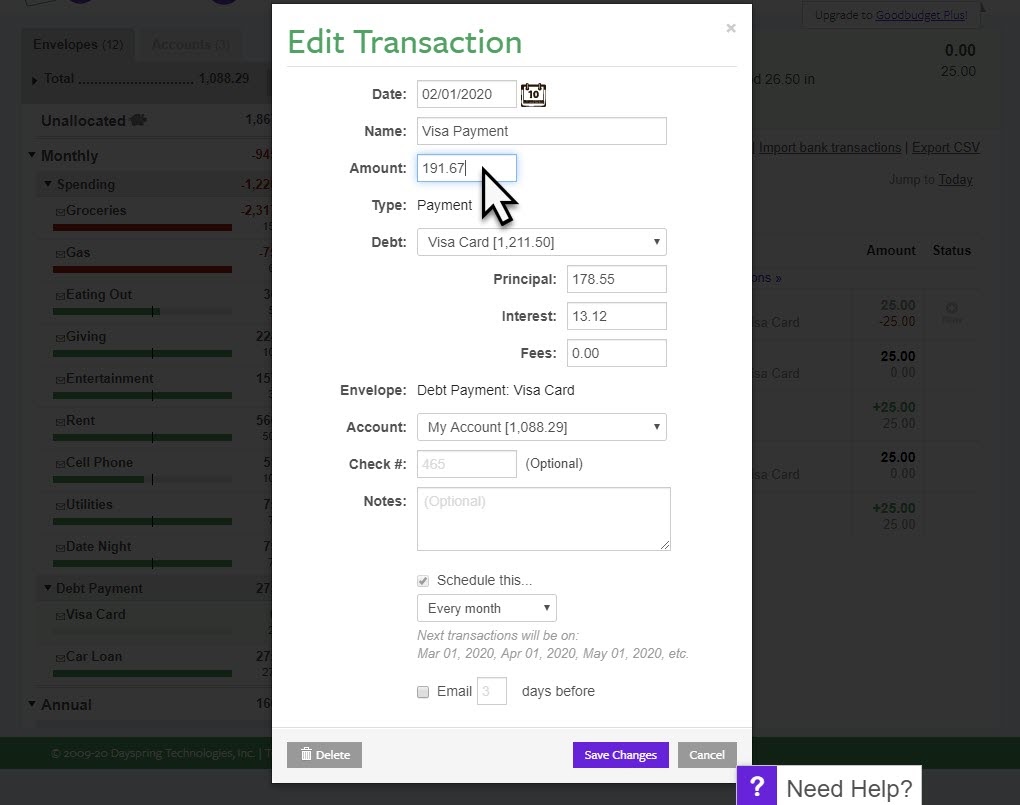

In this example, the Debt with the smallest payment is the Visa Card. So, we’ll add our extra of 166.67 on top of the current payment of 25. That means we’ll pay 191.67 going forward until it’s paid off.

Step 3: Update your Scheduled Debt Transaction

To make a new one, you’ll get started by clicking on Add Transaction > Debt Transaction. See a full tutorial on adding debt payments here.

Step 4: Pay off your debt!

Now, you’re on the way to paying off your smallest debt! And when you do, repeat the steps above to find your new Snowball so you can pay off your second smallest one. Then keep on going until you’re debt free.