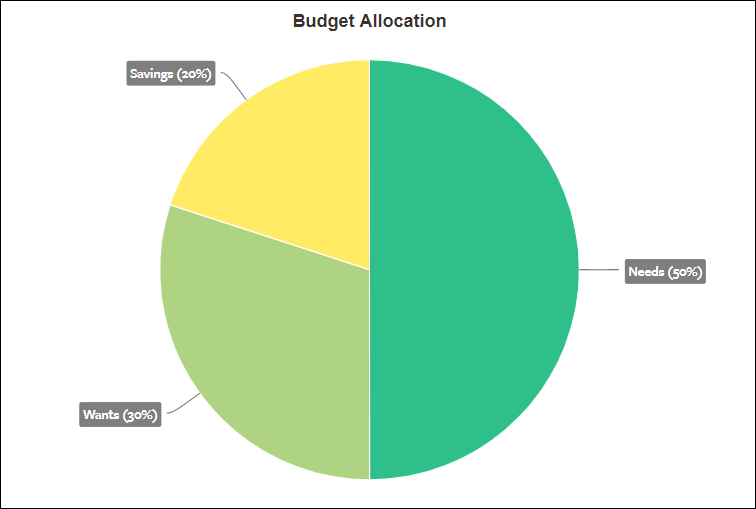

If starting a budget feels intimidating, start with a time-tested structure, like a 50/30/20 budget. As the name suggests, you break your budget into 50%, 30%, and 20% of your income. It allows you to proactively assign a role for each dollar you make. It’s a great way to manage your money, and it’s also the best way to make sure you’re not spending more than you make! Start with your after-tax income –the amount that goes into your bank account each paycheck– and break it down into three parts.

50% Needs: Expenses you have to pay, like rent, utilities, and groceries.

30% Wants: Expenses you choose to pay, like eating out, and entertainment.

20% Savings / Debt Reduction: Money you save, or use to pay down debt.

So, if you take home $2,000 a month, set a budget that allocates $1,000 to your needs, $600 to your wants, and $400 to your savings or debt reduction. Keep in mind that these are just guidelines. If you have to spend more than 50% on your needs, then do so.

Not only does budgeting this way give you flexibility in terms of how you apply it to your real-life spending, it also helps you be better prepared for potential financial emergencies. If you find you’ve lost part of your income, you know you can quickly pare down to a lean budget by stripping away Wants and Savings/Debt Reduction so you can focus on just the Needs. Then, when your emergency is over, you’ll be able to add those things back in with little effort.

The cherry on top is that this budget challenges you to focus a significant portion of your income towards Savings or Debt Reduction, which can allow you to accomplish those financial goals even faster.

When you’re ready, create your budget in Goodbudget. What Envelopes make up each of these categories will vary depending on your personal circumstances, but if it helps, feel free to use the Envelopes mentioned above as a starting point.